May 6, 2024

Farm Credit East Production Cost Index Plateaus at New High

Volume 18, Issue 5

May 2024

Sources: Farm Credit East analysis of USDA NASS Prices Paid Index

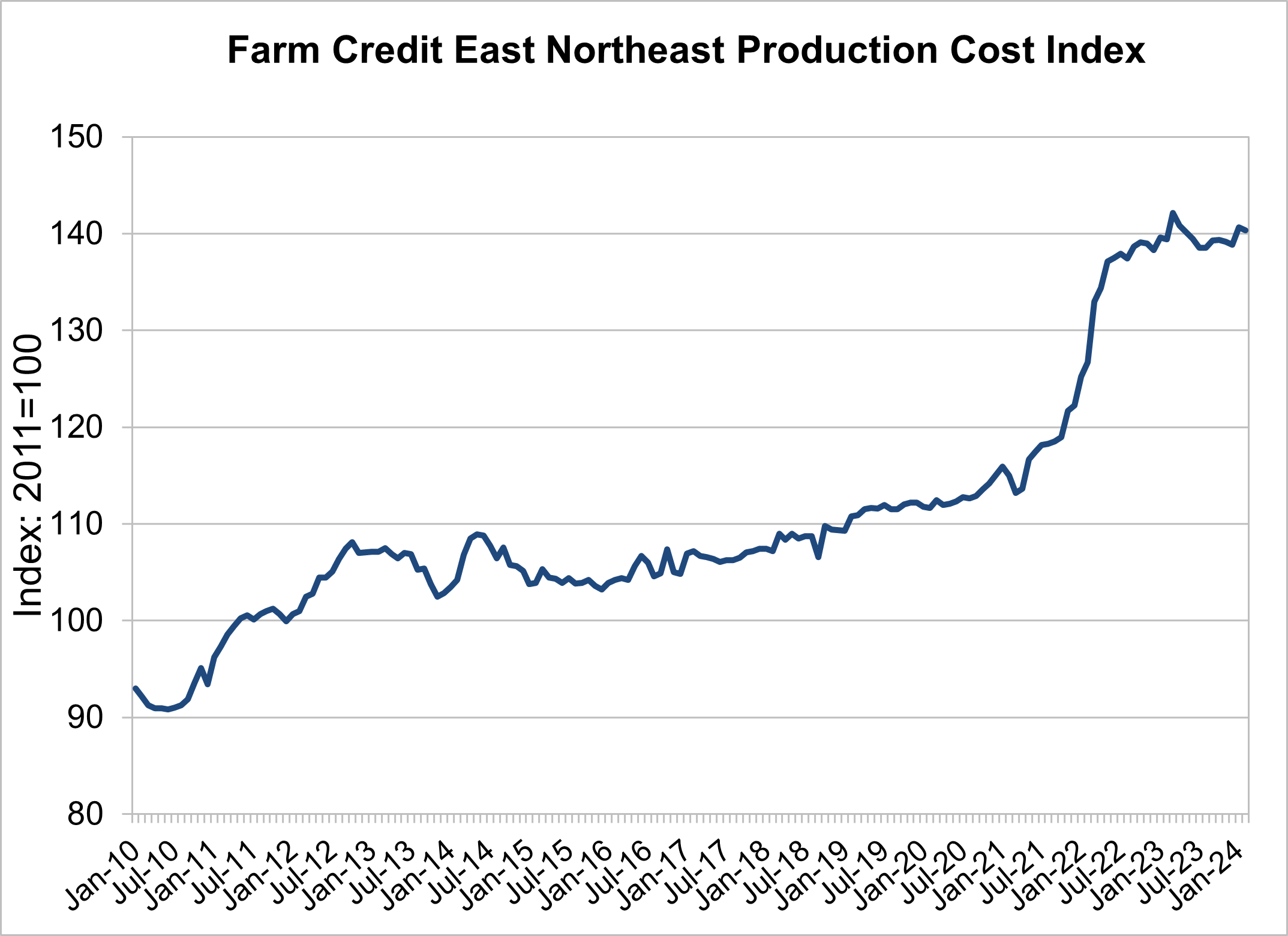

After a rapid rise in 2021 and 2022, the Farm Credit East Production Cost Index has plateaued after relatively modest increases over the previous decade. This index tracks farm production costs on a relative basis, weighted towards costs that affect Northeast producers most. Major components of the index include labor, energy, family living expenses, crop inputs, as well as costs like animal feed and other dairy-related expenses, given that sector’s prominence in our region. As the prices of these components increase, so does the Production Cost Index. The base index value of 100 is set at 2011 input cost levels.

In March 2022, the index reached a record high of 142, meaning that production costs were 142% of what they were in 2011. This was a 26% increase over March 2021, just one year earlier. Significant increases were observed in animal feed costs, fertilizers, fuels, supplies and repair costs, machinery and equipment, interest, labor, and family living expenses.

While production costs have risen sharply in the last couple of years, so have aggregate cash receipts for farms, helping to preserve margins in many cases. However, this varies widely by business model and cost structure. Some farms were able to increase revenues to offset rising input costs, either due to rising farm commodity prices, or by passing increases along to their customers. For other farms, receipts have not risen as fast as costs, which has led to shrinking margins.

As both costs and revenues have increased in most Northeast agricultural sectors, producers should analyze their margins and whether they need to increase their prices, decrease their costs, or navigate some combination of the two. For commodity producers, such as row crops or dairy, increasing prices may be difficult or impossible, so the focus would be on cost control and production efficiency. For producers selling to businesses or consumers, both revenues and costs come should be considered.

Over the last 12 months, costs have plateaued, providing somewhat of a respite for producers, but for the most part, the increases seen since 2020 have remained, keeping input costs at high levels, where they appear likely to stay or increase further. Meanwhile, farmgate receipts have varied. Grain and oilseed prices have declined, providing some respite for livestock producers, but squeezing margins for row crop growers. Milk prices have also fallen from their 2022 highs.

Agricultural retail and green industry businesses have largely been able to maintain pricing and sales volume over the last couple of years, but labor costs have been particularly challenging for these sectors. Labor costs have risen over the last several years, driven in part by statutory increases in the minimum wage in many states, as well as market forces.

It's difficult to predict how long the current plateau will last, before prices again increase significantly. The previous plateau, from roughly 2012-2017 lasted about 5 years. Indications are that this period will be more short-lived, as there is upward pressure on many inputs due to general inflation in the economy. The current plateau has occurred mainly because declining sectors, such as animal feed costs, energy, and fertilizer have been offset by sectors, with significant increases such as labor and interest rates.

Editor: Chris Laughton

Contributors: Tom Cosgrove and Chris Laughton

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: cost of production, ag economy