August 5, 2024

Seismic Shifts are Taking Place within Dairy

Volume 18, Issue 8

July 2024

Contributed by Corey A. Geiger, Lead Economist for Dairy, CoBank

There have been a number of structural shifts in our industry that appear to have some staying power. It’s important to gain a better understanding of these changes to implement on-farm strategies to capitalize on the market opportunities.

In the pole position would be milk’s butterfat composition. With each passing year, milk from our nation’s dairy farms yields more processed dairy products. That’s an important distinction in an era where consumers are purchasing more full-fat dairy products and ultimately eating their dairy in forms like cheese, butter and yogurt versus drinking their dairy as a fluid beverage.

Butterfat and protein top the charts

There’s been a multitude of reasons for growth in the butterfat story. Consumer demand leads the list as the war on saturated fats has subsided with scientific evidence pointing to the fact that some saturated fats deliver healthy fats in the human diet. Even though the USDA and FDA Dietary Guidelines for Americans still don’t recognize this fact, smart consumers are reading the scientific research and making their own decisions. There’s another reason for the higher sales for full-fat products – food’s flavor is found in fat.

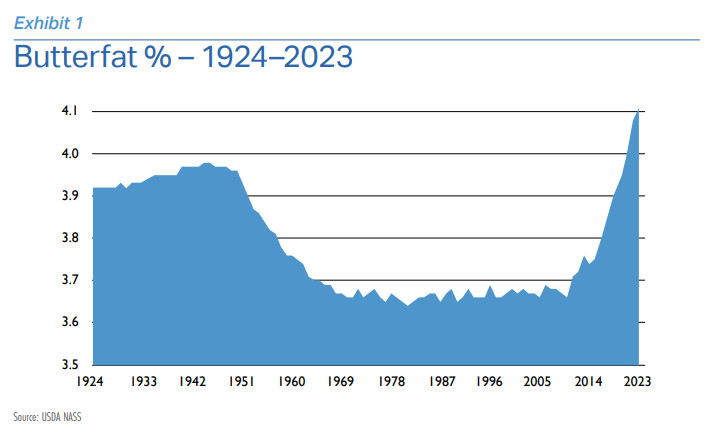

In 2021, the U.S. dairy industry surpassed the previous record output of 3.98% butterfat set in 1945. In the following two years, the average butterfat test moved to 4.08% in 2022 and 4.11% in 2023 as shown in Exhibit 1. Data from the start of the 2024 production year indicates the collective U.S. dairy industry will post the fourth consecutive record year for butterfat.

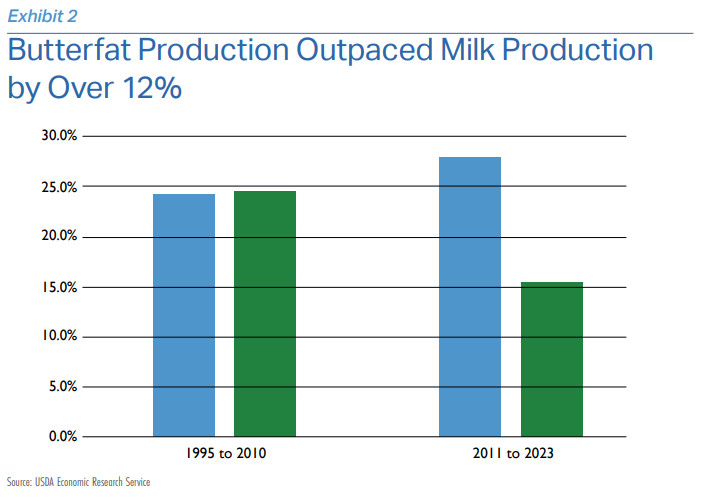

This shift in milkfat composition has caused metrics for milk production and butterfat production to decouple. From 1995 to 2010, butterfat production and milk production were one in the same growing at 24.1% and 24.2% respectively. Since 2011, growth in butterfat production has far outpaced milk growth at 27.9% versus 15.4%. That’s a 12.5% difference as shown in Exhibit 2. In the years ahead, this spread between butterfat and milk is only going to grow.

Given this market dynamic, it behooves every dairy farmer shipping milk under Multiple Component Pricing (MCP) provisions to find ways to maximize components. MCP provisions are the standard for 92% of the milk produced in the United States. In 2023, 58% of the MCP revenue came from butterfat, 31% from protein, 6% from the producer price differential and 5% from other solids. Given current market conditions, butterfat will continue to lead milk check revenue in 2024 and likely deep into 2025.

Also, the upside for butterfat and one of its main end products - butter - remains strong as the U.S. still does not produce enough butterfat to serve the domestic market. In fact, butter product imports into the U.S. have grown 13-fold from 2011 to 2023 moving from 10.2 to 123.9 million pounds.

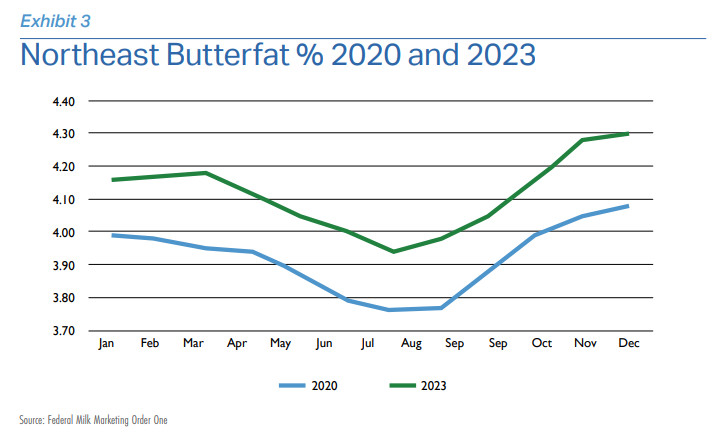

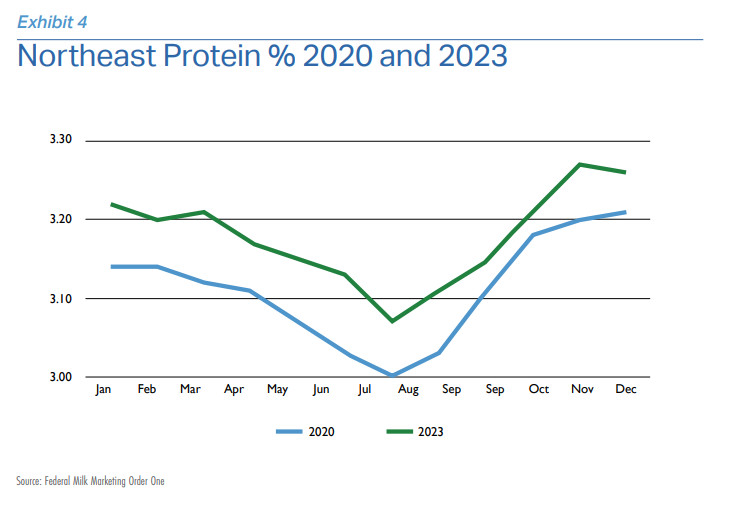

Butterfat is just one part of the MCP story as protein is the other leading component. While national data on protein growth is somewhat limited and less historic when compared to butterfat, Federal Milk Marketing Order (FMMO) data is a solid source. Exhibits 3 and 4 show the four-year shift in milk’s two main components.

How is your farm meeting this market opportunity?

You can easily compare your milk shipments to the national average to track your progress. The amino acids found in dairy are the most complete known to humanity, making whey proteins a high-demand product by those looking to consume high-quality protein. That will make whey protein a growth sales category for many years to come.

Changing genetics to meet changing markets

The original A.I., as in artificial insemination, has long been used by dairy farmers to improve their dairy herds. However, two relatively recent market tools have stepped up the importance of an A.I. program on everyone’s dairy farm – genomics and sexed semen.

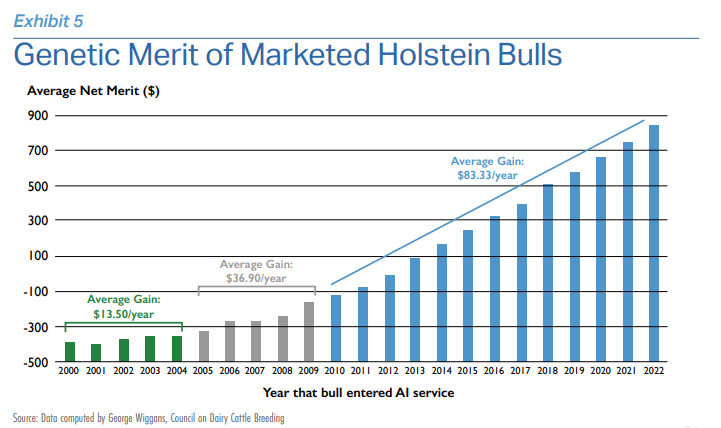

Genomics first came upon the scene in 2008. Very quickly it began to change the pace of genetic progress. Prior to 2008, by using the best available Holsteins bulls on your herd the pace of genetic progress would improve by $13.50 Net Merit each year as shown in Exhibit 5. By 2010 that number leapt to $83.33 annually as calculated by George Wiggans with the Council on Dairy Cattle Breeding. And since dairy cattle are often kept on dairy farms for successive generations, this area has become the most important investment in genetics, even dare I say topping that found in seed genetics for crops. That’s because those dairy farmers who raise their heifer calves for the next generation of herd replacements can capitalize on these additive genetics just like compounding interest.

While a great deal of the progress from genomics can be found on the sire side, the female side is growing in importance with each passing year. In May 2024, the collective U.S. dairy industry ran its 9 millionth genomic test making the dairy cow the most studied domestic animal on the planet. By running that test on a newborn dairy calf, we instantly know with 70% accuracy how that calf will perform as a dairy cow and thus no longer need to place capital resources into future replacements that will under achieve.

Sexed semen has been a near equal to genomics and dairy farmers are voting with their accounts payable. In 2022, 49% of the dairy bull semen sold in the United States was reverse sorted to create heifer calves. By the very next year, that number moved to 54% as dairy farmers are planning their future replacements from the very best heifers and cows in the dairy herd. This is the first time that conventional bull semen with 50-50 sex ratios has been in second place in market share. That number will continue to dwindle given the emerging market opportunities.

The door opens to beef on dairy

Sexed dairy semen to yield a far higher ratio of heifer calves flung the doors open on a new opportunity – using beef semen on dairy cows to capitalize higher beef yields from the resulting offspring and the limited supply of beef in current U.S. markets.

This move happened swiftly as the U.S. A.I. industry collectively sold 2.5 million units of beef semen in 2017. By 2019 that number vaulted to 5.8 million units and then bounded for a new record of 9 million units by 2023, as reported by the National Association of Animal Breeders (NAAB) that represents nearly 95% of the A.I. market. Of that 9-million-unit total in 2023, 7.9 million units were sold to dairy farmers meaning that only 1.5 million units were sold to cattle ranchers. This doubles down on the narrative that the dairy cow is the most studied animal on the planet and one day a beef brand could emerge backed by the data collected by the dairy industry.

The beef-on-dairy trend will not be fading any time soon given the value of the newborn crossed calves. In addition, there are market dynamics in the greater livestock sector that point to this being a long-term opportunity. That value proposition is being driven by four fundamental factors:

- The total cattle inventory of 87.15 million head. This number, which includes both beef and dairy, is at the lowest levels since 1951.

- The total beef cow inventory at 28.2 million head stands at the lowest mark since 1961.

- Feeder cattle supplies have fallen to 24.2 million head, which is the smallest total since 1972.

- Keep in mind that the U.S. population included 148 million people in 1951. Fast forward to the present and the U.S. population has grown 126%. That means there are 335 million Americans vying to purchase smaller beef inventories.

With some 3 to 3.25 million head of beef-on-dairy crossed animals in the countryside, as estimated by Dale Woerner of Texas Tech University, it stands to reason that dairy replacement inventories are down, too. The beef-on-dairy trend has presented such a seismic shift that dairy replacements 500-pounds and larger, a proxy of the number of females available to enter the dairy herd in the upcoming year, is down 709,100 head from just six years ago. This represents a 20-year low based on USDA data.

That means higher prices for dairy farmers looking to purchase dairy replacements. Just two years ago, a buyer could have had their pick of heifers for as little as $1,600 per head. That number has catapulted to prices near $3,000 and given the supply situation, that number will remain strong for the next two to three years. For those dairy farmers looking to grow their dairy farms by purchasing heifers, that line item will need an adjustment.

Given these high prices and scarcity of replacements, dairy farmers have pulled way back on culling. Through May 2024, dairy cow culling was off 177,100 head. This emerging culling trend is another situation that warrants monitoring throughout the coming months and years.

HPAI remains a concern

In March, dairy farmers came to learn that cows can get avian influenza. By mid-June, the Highly Pathogenic Avian Influenza (HPAI) strain known as H5N1 was documented to be in dairy cattle in over a dozen states. It stands to reason that the virus will spread further given the migration patterns of wild bird flocks. Fortunately for those of us in the dairy industry, cows have proven to be resilient and recover from an infection.

So far, consumer demand has largely not been impacted by HPAI concerns even though the topic receives near-daily coverage in national media outlets. There are two reasons for largely unwavering consumer demand – pasteurization has been proven to deactivate the virus and the proper cooking of beef is a great method for food safety.

To double down on beef safety, USDA conducted meat tissue samples on 96 cull dairy cows that were condemned for systemic diseases at select Food and Safety Inspection Service (FSIS) facilities. Once condemned, meat from those cows is prohibited from entering the human food supply. While one cow did test positive for the H5N1 virus that causes HPAI in dairy cows, the other 95 cows tested negative for viral particles.

During this in-depth study, FSIS collected multiple tissue samples, including meat samples from the diaphragm. The working theory is that testing the diaphragm would yield the highest positive test results as this muscle is most closely connected to the lungs, which is where the HPAI virus infects cattle.

Dairy farmers have long used vaccinations to keep their herds safe and ultimately that may become the best solution to overcome this latest challenge. The federal government is nearing an agreement to bankroll a late-stage trial of Moderna’s mRNA pandemic bird flu vaccine for humans. The federal funding could come as early as July. Also, the USDA is to begin testing a vaccine developed by University of Pennsylvania researchers by giving it to calves.

Dairy demand points mostly positive

There are three important channels to move dairy products – retail, food service and exports. Futures prices indicate that 2024 could be the third-highest milk price year on record. However, sluggish international dairy trade and tepid domestic consumer demand in restaurants due to four years of inflationary forces have been slowing growth in dairy product sales in the first half of 2024. On the international front, China, the world’s largest dairy product importer, has pulled back on its purchases.

If consumer demand keeps building as it has in mid-2024, the remainder of this year could point to stronger sales. When coupled with lower forecasted feed prices, there could be some positive market opportunities for dairy farmers. To better secure positive returns, consider implementing risk mitigation strategies on both milk, feed and other inputs.

This article was first published in the 2023 Northeast Dairy Farm Summary.

You can view the entire report here.

Editor: Chris Laughton

Contributors: Corey A. Geiger, Lead Economist for Dairy, CoBank

Corey Geiger is the Lead Economist for Dairy with CoBank’s Knowledge Exchange Division and previously served on the editorial team for Hoard’s Dairyman for 28 years. He earned degrees in agricultural economics and dairy science at the University of Wisconsin-Madison

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

Tags: dairy, outlook, ag economy