November 5, 2024

Grain and Biofuel Outlook: Biofuels Creating Needed Demand for Ample U.S. Harvests

Contents

Volume 18, Issue 11

November 2024

Grains & Oilseeds

Contributed by Tanner Ehmke, CoBank Knowledge Exchange

U.S. farmers are harvesting a record soybean crop and the third-largest corn crop on top of large carryover stocks from the previous marketing year. Carries have returned to the futures market as a result, making storage more profitable. This is a remarkably different market environment compared to prior years when inverted markets penalized storage. A storage hedge for farmers makes more economic sense with spreads in the futures market now at full-financial carry (i.e., covering the interest expense on stored grain).

Ample U.S. harvests have coincided with a plethora of export headwinds. A strong U.S. dollar, political uncertainty over trade policy, stalled rail shipments into Mexico, and low water levels on the Mississippi River – the main artery for U.S. grain and oilseed exports – have frustrated U.S. exports. Export demand for U.S. grains and oilseeds, though, is showing signs of recovery as droughts in Brazil and Russia send global buyers back to the U.S. Biofuels, meanwhile, have thankfully been a strong source of demand amid an uncertain export environment (see biofuels section below).

Corn

Record corn yields are projected to produce a 15.19-billion-bushel corn crop this fall, which will be piled on top of large carryover stocks from last year’s record harvest. U.S. corn stocks on Sept. 1 were tallied at 1.76 billion bushels, up 29% YoY, bringing total U.S. corn supply to the second largest on record. Usage for the quarter, though, was greater than expected. Export demand is resurging with total export commitments now up 17.3% YoY versus last year’s record harvest, with sales to top-customer Mexico up 12.6% YoY.

Ethanol also remains the bright spot for corn demand with corn ground for ethanol use holding at record levels. Policy uncertainty over carbon tax credits and falling gasoline and ethanol prices, though, threaten the strong usage pace.

Soybeans

The next three months will be critical for U.S. soybean exports with half of the U.S. soybean crop typically shipped in October, November and December. Total export commitments for the new crop are down 0.4% YoY. Chinese bookings are down 8.7% YoY on sagging Chinese crush margins and uncertainty over trade policy, but fears over drought in Brazil have awakened demand. Domestic usage also continues to rise as processors hasten their crush pace to fill growing demand for renewable diesel derived from soyoil and other vegoils. U.S. farmers in the meantime are harvesting a record large soybean crop of 4.59 billion bushels, up 10% YoY. Carryover stocks on Sept. 1 were tallied at 342 million bushels, up 29% YoY.

Attention now turns to the South American soybean crop where historically dry conditions have delayed planting in Brazil. China’s fiscal stimulus has also raised hopes of an economic recovery boosting China’s soybean crush margins next quarter and lifting demand for soybeans.

Wheat

U.S. winter wheat farmers are planting the 2025-26 crop with acreage expected to drop slightly YoY. Farmers are shifting more acres to forage crops amid high livestock prices and low wheat prices. The expansion of the Conservation Reserve Program (CRP) will also reduce wheat acres. U.S. wheat stocks on Sept. 1 totaled 1.99 million bushels, up 12% YoY.

Globally, wheat stocks are tight. Dry conditions in the Black Sea raise concern for the Russian and Ukrainian winter wheat crops, but a weak Russian Ruble continues to anchor world wheat prices. Attention turns to Southern Hemisphere harvests in Argentina and Australia and supply availability into early 2025.

Biofuels

Contributed by Jacqui Fatka, CoBank Knowledge Exchange

U.S. ethanol plants are coming off seasonal high near-record amounts of corn used for fuel-alcohol production this summer. As many shut down for maintenance in August, plants are now ready to take advantage of this fall’s bumper harvest to keep production climbing. The fourth quarter brings lower gasoline use, meaning lower domestic ethanol use. Improved corn oil extract rates will help plants’ revenue returns.

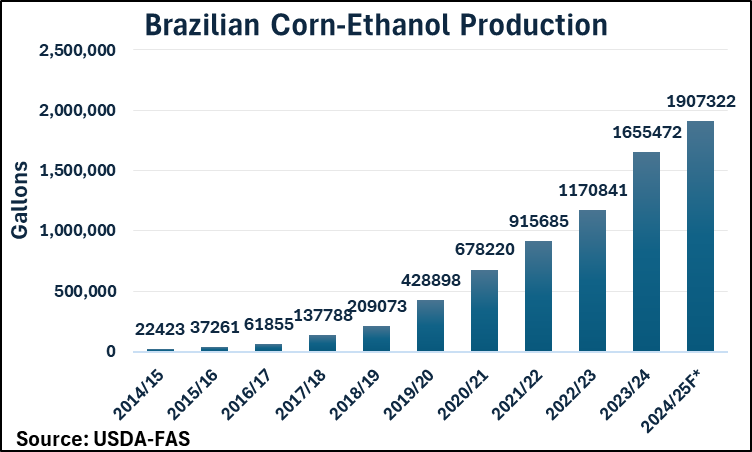

Ethanol exports started the 2025 marketing year Sept. 1, building on 2024’s record levels, forecast at $4.3 billion and a record 2 billion gallons. More ethanol export competition could be on the horizon with Brazil constructing new corn-ethanol plants in addition to its sugarcane-based facilities. Brazil’s ethanol production was up 41% from the (April to March) Brazilian marketing year prior, reaching 15.85 billion gallons and nameplate capacity of 19 billion gallons this year. Brazil’s 22 corn ethanol plants now consume 15% of its domestic corn production, which equates to 17 MMT for the 2023/24 crop season.

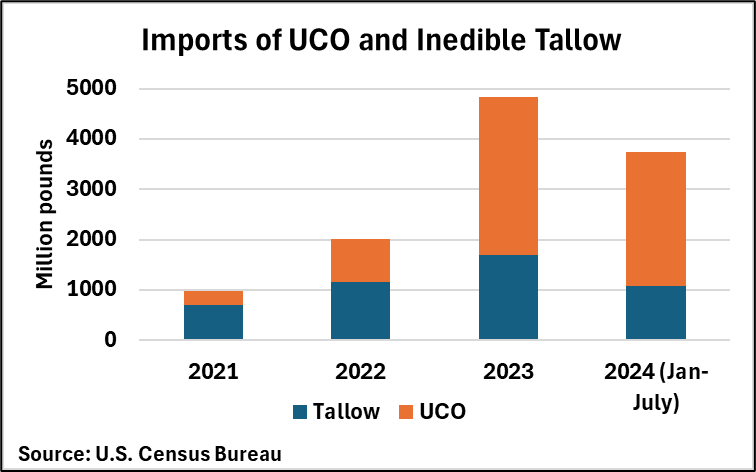

Soy oil demand for renewable diesel and biodiesel markets continue to face headwinds from rising imports of used cooking oil and tallow mostly from China and Brazil, which now account for an estimated one out of six gallons of U.S.-produced biomass-based diesel, according to the Renewable Fuels Association. Domestic producers want 45Z tax credits to apply only to domestic feedstocks for feedstocks, but administration officials warn this could lead to trade retaliation.

Editor: Chris Laughton

Contributors:

Tanner Ehmke, CoBank Lead Economist, Grains and Oilseeds

Tanner Ehmke is lead economist for grains and oilseeds in CoBank’s Knowledge Exchange research division. His focus is on providing market and industry research for the wheat, corn, soybean and rice sectors. Prior to joining CoBank in 2015, he marketed seed for his family’s seed company in western Kansas, where his family has farmed since 1885.

Jacqui Fatka, CoBank Lead Economist, Farm Supply and Biofuels

Jacqui Fatka is lead economist for farm supply and biofuels in CoBank’s Knowledge Exchange research division. Over the past 20 years, she’s honed her expertise in ag policy, biofuels, trade, regulations, ag labor, climate-smart agriculture and farm management.

View previous editions of the KEP

Farm Credit East Disclaimer: The information provided in this communication/newsletter is not intended to be investment, tax, or legal advice and should not be relied upon by recipients for such purposes. Farm Credit East does not make any representation or warranty regarding the content, and disclaims any responsibility for the information, materials, third-party opinions, and data included in this report. In no event will Farm Credit East be liable for any decision made or actions taken by any person or persons relying on the information contained in this report.

2025 Grain and Oilseed Industry Outlook Webinar

On Monday, January 6, 2025, at 12:00 PM EST join Farm Credit East and guests, CoBank Lead Economists, Tanner Ehmke and Jacqui Fatka, to explore the latest insights on U.S. grain and biofuel markets.

Tags: outlook, ag economy, cash field